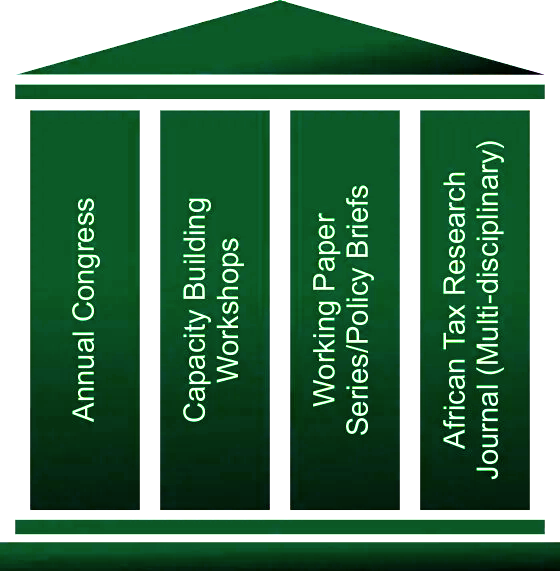

ATRN Pillar Activities

The outputs of the ATRN are the Annual Congress, the ATRN working paper series, capacity-building workshops and the envisaged African Tax Research Journal.

The Annual Congress is the network's flagship activity. It gives researchers a platform to present their research to an audience of decision-makers in ministries of finance, tax administrations and civil society organisations, as well as to academic researchers and tax practitioners. The Annual Congress has addressed themes such as these:

- Contemporary tax challenges for African countries

- Financing sustainable development in Africa: Identifying untapped and underutilised sources of revenue

- A modern and effective taxation system to advance domestic resource mobilisation in Africa: The role of information technology and tax information exchange.

Themes are decided on in a consultative manner and based on a needs assessment of tax administrations, academics and other researchers.

The ATRN working paper series and policy briefs improve the accessibility of research for academic faculties, practitioners and students to reflect on ideas or concepts that are still being developed, thereby improving the opportunities for discussion and comments. The ATRN capacity building workshops aim at strengthening the research capacity of junior to mid-career researchers who are already working in the area of taxation but who feel their work could be improved with more rigorous methods. The peer-reviewed African Tax Research Journal (ATRJ) will serve as a publication platform for research papers in the field of tax administration, and tax legislation and policy. The journal is envisioned to be an essential tool for tax officials, policy-makers and academics, as well as students and other people who are interested in the field of taxation.

The ATRN has an Advisory Board and a Scientific Committee that are responsible for the network's quality assurance. ATRN members are a vital tool in fostering an effective research network and in exercising an increasingly bigger influence on tax issues in Africa.